What the US election means for Australia

As the US election approaches, the risks of renewed inflation and unpredictable fiscal policies could complicate the global economic landscape, with significant implications for Australia.

This post follows from Friday's essay on whether we should be worried about the US, which in my view is one of the most important questions to be asking right now given it's just just over a week from what looks set to be yet another highly divisive US federal election!

Inflation is dead... or is it

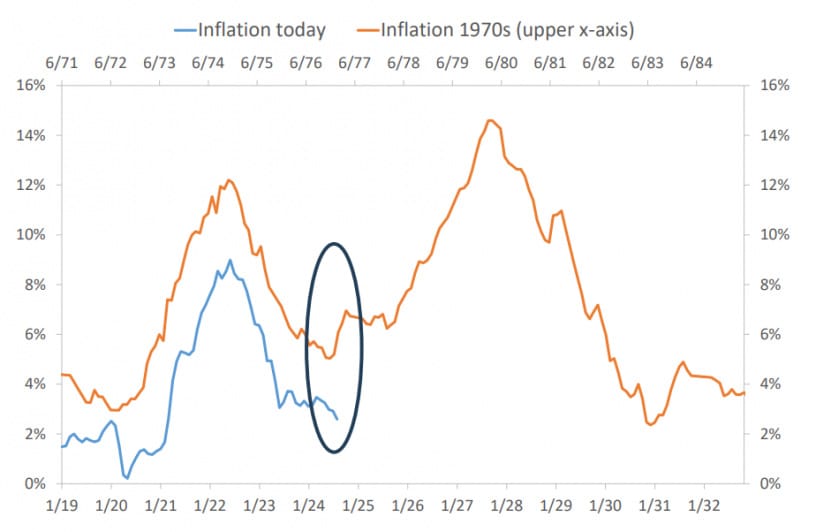

Jesper Rangvid recently analysed the inflation situation in the US, drawing parallels with the 1970s. Correlation doesn't imply causation, but what it does show is there's at least one historical episode where a 'soft landing' was actually quite bumpy:

Of course, the 1970s were very different to today. For example, there were real shocks (e.g. oil crises) and widespread price controls that distorted the data, making it appear as though inflation was falling when it was still bubbling away in the background – sort of what the Albanese government is doing with its "cost of living" relief, but much more economically damaging.

None of that is happening today (at least not yet), so inflation is unlikely to shoot back up without a policy mistake. On that note, Rangvid warns that there are two risks "that could reignite inflation" in the US:

"First, monetary policy could become overly loose. Markets anticipate a 50-basis-point cut this year and a further 100-125 basis points next year, and Fed governors expect about the same, as revealed by their 'dot plots'. This comes against the backdrop of a strong underlying economy, as noted earlier. In fact, the strength of the current US economy argues against further interest rate cuts, yet they are still likely to happen. There is a risk that future rate cuts could be too aggressive, potentially reigniting inflation. While this is not my base case—I still expect a soft landing—it is a risk we cannot ignore entirely.

The second risk is political: the upcoming U.S. election. Without delving too deeply into politics, it is fair to say that Trump's policies, if he wins, could be inflationary. A more politicised Fed (i.e., one that adopts an even more expansionary monetary policy), tariffs, quotas, import levies, and so forth, as well as highly expansionary fiscal policies, all point toward rising inflation. While this would not happen immediately, it is a risk we cannot fully dismiss."

The US Fed has already cooled on the idea of further rate cuts, so the biggest risk is the second one: the election, and the potential for a sharp deterioration in the federal budget deficit that drives up inflation expectations. That risk would be greater with a Trump presidency given his public statements questioning the need for an independent Fed, and that he believes "the job involves showing up once a month and flipping a coin".

Trump's climb up the polls and on betting sites might then explain why US 10-year Treasury yields have risen from around 3.6% to over 4.2% in a month: perhaps people's expectations of future inflation are rising. Another reason might be rising inflation risk premia, perhaps because the outlook for the US deficit has deteriorated as the candidates' big-spending policies are revealed without credible plans to pay for them all.