The wealth of our working nation

Japan's "lost decades" of low growth are due to its declining working-age population, not necessarily failed policies. With aging populations, policymakers in developed nations such as Australia will need to focus on right metrics, not just GDP growth, to craft effective policies.

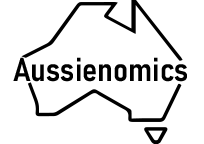

Australia has a "high-income economy", as defined by the World Bank. But are incomes the best way to measure how well we're doing, relative to other countries? If you looked only at incomes, or a proxy such as real GDP per capita, we don't look all that bad when compared to the US, and we do very well against Japan:

What's going on in Japan? Starting with its so-called lost decade, Japan has been the subject of many studies, such as this 2003 report from the IMF:

"Real GDP growth has averaged 1 percent a year over the past 10 years, well below that in other OECD countries, and only one-fourth of the 4 percent annual average growth rate recorded in Japan in the 1980s. Japan, moreover, experienced three recessions in the past decade, in contrast to the trend in other industrial countries toward milder and less frequent downturns in the postwar period. Meanwhile, nominal GDP has fared even worse than real GDP (the level of nominal GDP in 2001 was approximately the same as in 1995), as moderate deflation has become entrenched. This poor economic performance has led some commentators to call the 1990s Japan's 'lost decade'."

Two more decades have now passed and the situation hasn't really changed, despite the best efforts of economists and politicians who have tried to 'fix it' ever since. A more recent term used to describe growth slowdowns anywhere in the developed world is the "Japanization" of their economy, such is the perceived plight of Japan.

But what if Japan never had a lost decade, or decades, to begin with? A new paper asked precisely that question:

"The paradigmatic case for how misleading the notion of output growth per capita has become is Japan. Between 1990 and 2019, GDP in Japan grew at an annual rate of 0.93%, much lower than the 2.49% of the U.S. This seemingly disappointing performance motivated a myriad of books and academic papers analysing the origins of Japan’s lackluster growth and presenting a multitude of policy remedies.

...

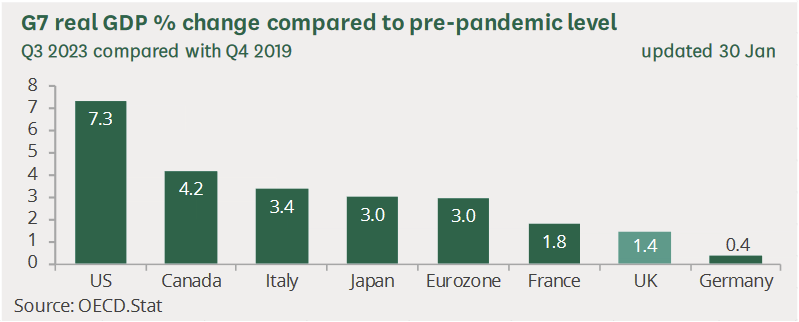

However, the outlook is dramatically different if we look at GDP per working-age adult. Japan has grown at an annual rate of 1.44%, while the U.S. has grown at a very similar 1.56%. Indeed, from 1998 to 2019, Japan has grown slightly faster than the U.S. in terms of per working-age adult: an accumulated 31.9% vs. 29.5%. Even more strikingly, if we focus on the period 2008-2019 (i.e., after the outbreak of the financial crisis), Japan has the highest growth rate in terms of per working-age adult among our sample of G7 countries plus Spain."

It's all about demographics

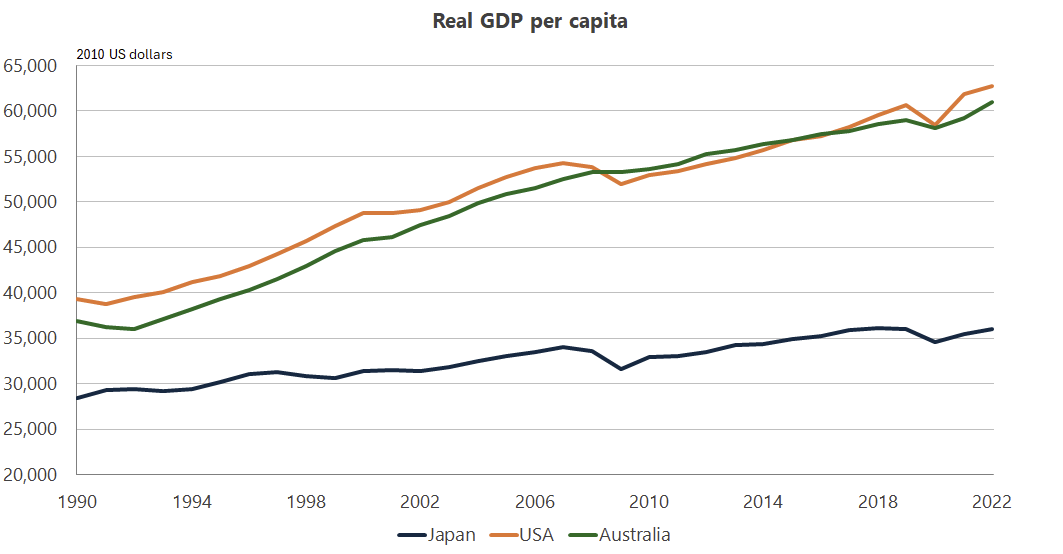

The authors argue that Japan's "lost decades" are due entirely to the ongoing decline in its working-age population. Once you control for that variable, Japan – the dashed green line in the charts below – doesn't look so bad (bottom left chart).

The authors also show that if you drop the early 1990s from the sample (after Japan's asset bubble burst) and instead start the analysis in 1998, Japan has grown faster than any of the countries above in terms of GDP to working-age adults.

To the authors, the most interesting case is not Japan but Italy, the worst performing country in terms of its GDP to working aged population ratio:

"Italy did not have a financial collapse (like Ireland) nor was it under a memorandum of understanding with the European Union (like Spain in July 2012). Italy's problems seem deeper than digesting the aftermath of a financial meltdown."

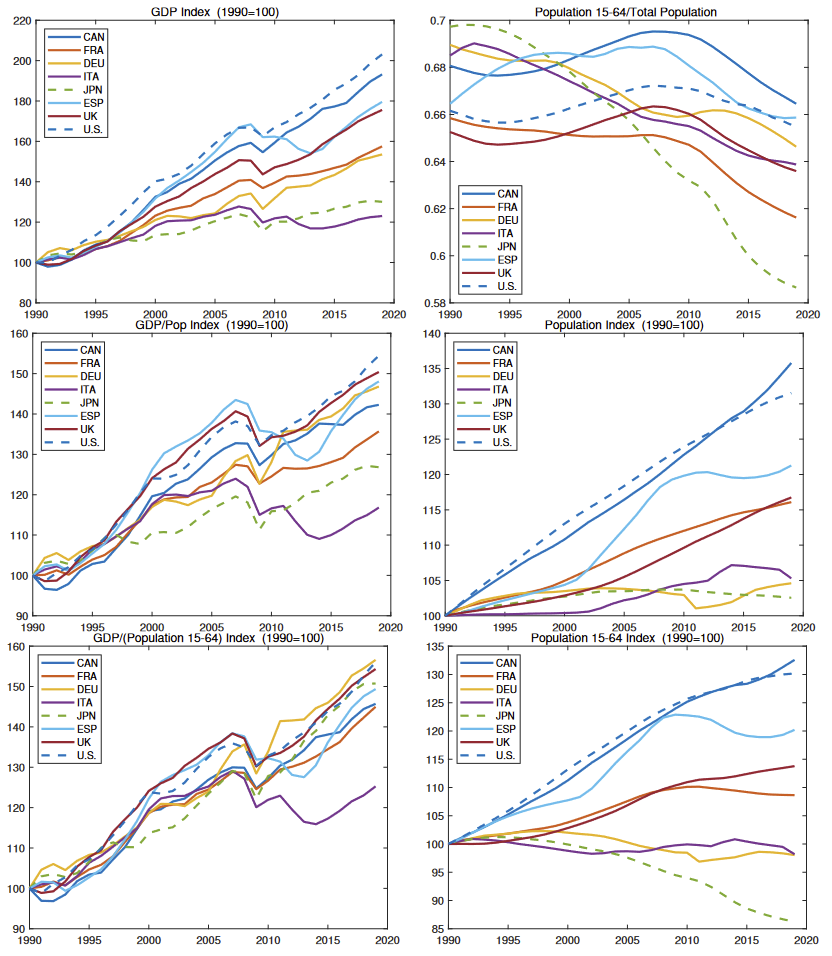

To me Germany is perhaps the most impressive, as not only does it lead all other countries but Germans work significantly fewer hours each year than anyone else.

Notice, though, that the study stops in 2019 and the hours worked data in 2017. In more recent years, the German model of coasting by on the back of cheap Russian gas while dismantling its nuclear facilities may have reached its used-by date: Germany has been in or close to recession for years now and has by far the weakest economy in the G7.

How policy can go awry

Japan's government and central bank have been fighting its economic decline since the late 1990s. Our very own former RBA board member, Warrick McKibben, wrote the final chapter of the 2003 IMF report I mentioned above, describing the policies that were currently underway (and never stopped being attempted!):

"Prime Minister Koizumi has advocated an action plan focused on addressing the weaknesses in the banking sector, bringing about fiscal reform and consolidation, and accelerating structural reforms to raise productivity growth. There have also been calls for further monetary easing to arrest ongoing deflation."

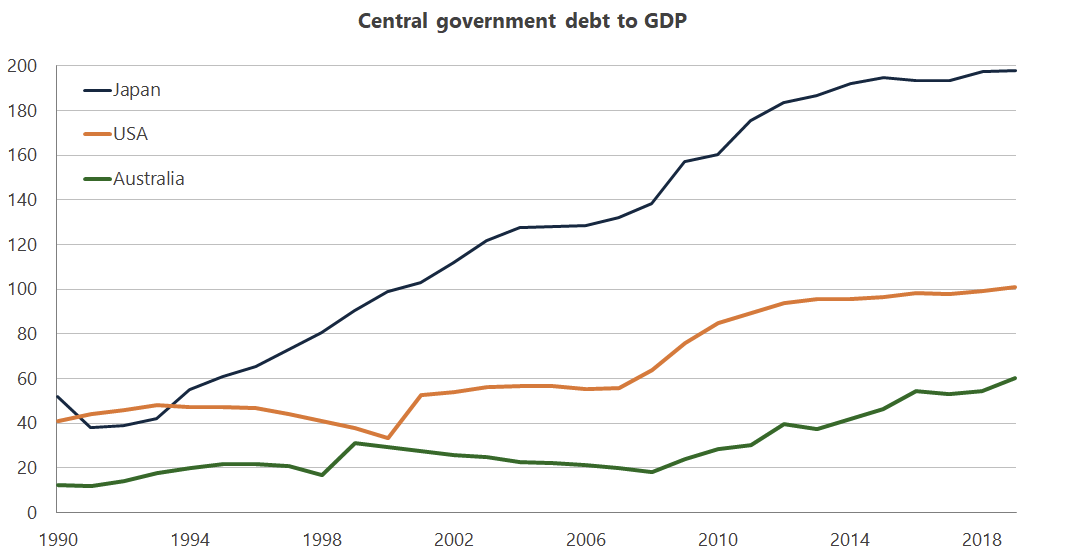

Those are all valid policy responses to an economic slowdown but have to be carefully designed if the slowdown is due to demographics. And Japan's government hasn't been all that careful: more often than not it has relied on fiscal and monetary stimulus than structural reform, when the latter would be far more useful.

In doing so, it has ignored the cold hard truth that if your fertility rate collapses and you don't compensate with higher rates of immigration, your aged dependency ratio will rise and from that point it's very difficult to achieve aggregate or per capita economic growth.

That's an important fact to remember as our Boomers retire and we inch up towards Japan's aged dependency ratio: once-reliable indicators of well-being, such as GDP and GDP per capita, may no longer tell the whole story. If policymakers focus on "fixing" them, they may inadvertently make us all worse off.

How does Australia compare

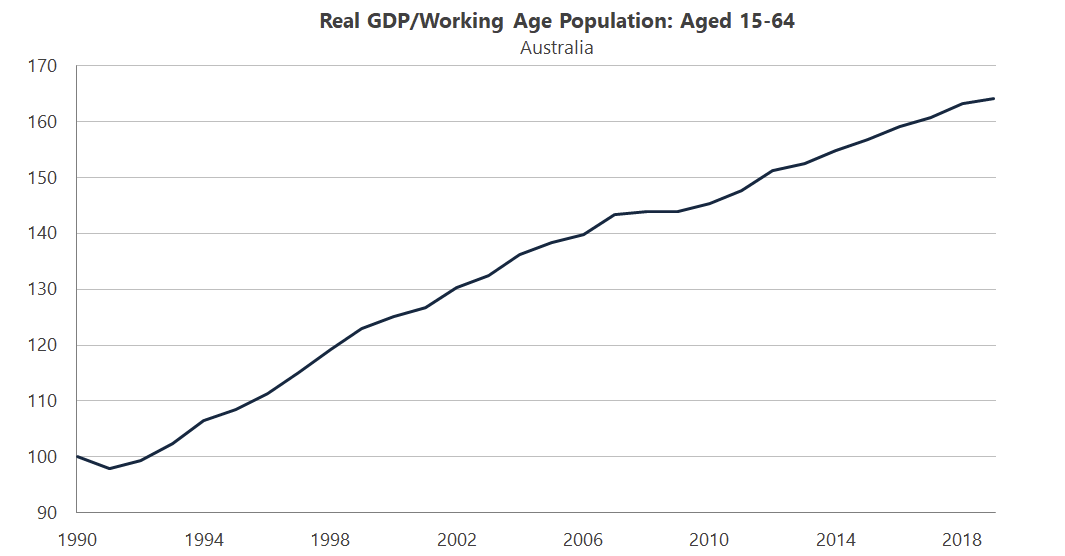

The lack of a material slowdown during the Great Recession in 2008-09 (thanks, Chinese stimulus!) meant that since 1990, Australia has outperformed all of the countries studied above.

We've managed to offset declining fertility rates with world-leading levels of immigration, helped in no small part by the emergence of China – by far our biggest trading partner – on the world stage.

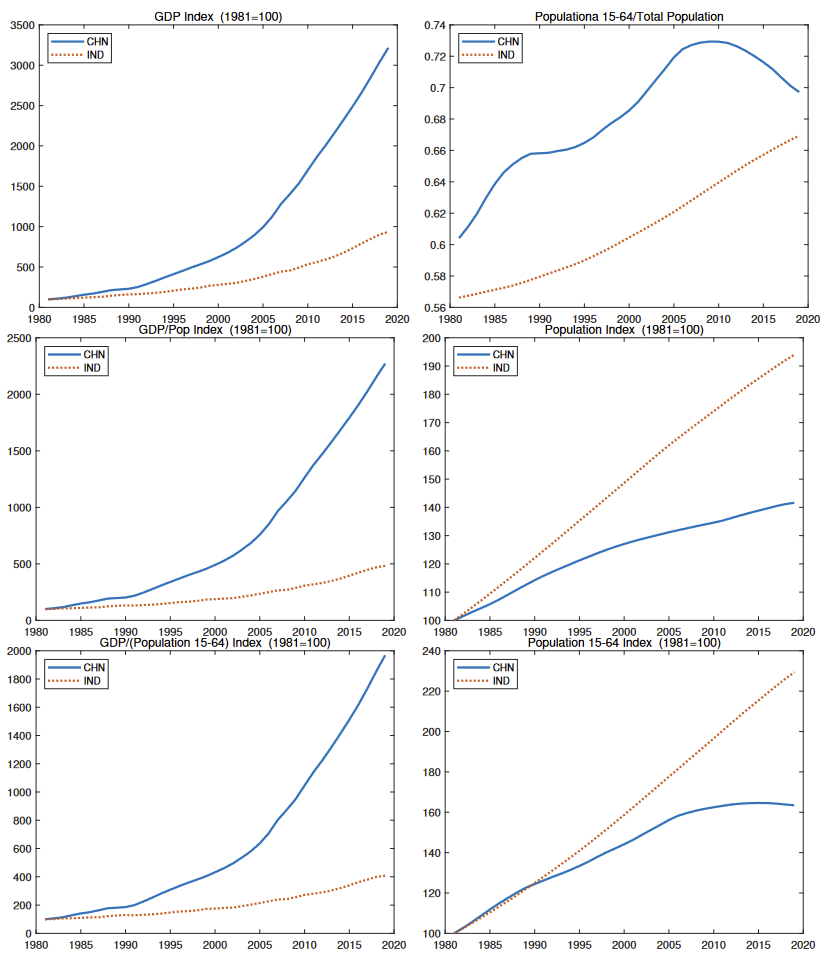

Speaking of China, as a thought experiment the authors also looked at it and India, the world's two most populous countries. China has done better than the much poorer India at everything except adding more people.

According to the authors:

"The populations of China and India have not aged enough to make the use of GDP per capita misleading from the perspective of growth theory. However, as China (over the next two decades) and India (starting around 2040) start feeling the effects of much more acute aging, we will see the same mechanisms at work as for the G7 and Spain."

China's government still publishes optimistic annual GDP growth targets. If it fails to acknowledge its changing demographics and the limitations that will place on potential GDP or GDP per capita growth, it will fall into the same trap as Japan's policymakers and end up pushing against a string.

It's important to ask the right questions

The authors don't dismiss other variables. For example, they rightly point out that GDP "matters for public debt and social security sustainability", while GDP per capita "gives us a sense of how fast the average resources available to each inhabitant of an economy are changing", and that a nation's total population can be used "to evaluate social welfare growth".

With reference to Japan, the authors conclude that:

"Judging Japanese monetary policy from 1990 to 2019 as a failure because it could not deliver faster output growth per capita faces the fundamental challenge that monetary policy can do next to nothing about long-run demographic forces. Given that Japan's and the U.S.' output growth per working-age adult was roughly the same between 1990 and 2019, it is hard to see what else the Bank of Japan could have done."

Perhaps Japan's output per worker grew in spite of the Bank of Japan's easy money policy, but that's a subject for another essay. The point is there's very little monetary policy can do to address changes in demographics.

Above all else, what this study shows is that we need to ask the right questions or we can very easily end up with poor policy outcomes. As economist John Cochrane aptly summarised:

"If you want to know how many aircraft carriers a country can build, or if the government can repay its debts, you want GDP. If you want to measure labour productivity, the fundamental efficiency of its businesses, you want GDP per hour. (Jesus brought up a very important limitation there: Europe has had more restrictive labor laws and more low skill people just not working. That fact boosts average productivity. The US seems to be 'catching up' in this regard.) If you want to measure overall average standard of living, GDP per person is a good beginning. GDP per working-age person is a measure of productivity that includes all the impediments from high taxes to regulations that discourage people working. It leaves out fertility, a country's crucial ability to produce workers to pay for everyone else. That is an important issue, but it is at least a very long run issue, and not one on which we have well understood policies."

For now, Australia doesn't have an issue with misleading GDP and GDP per capita numbers because we take in enough immigrants to offset declining fertility; they're still a good enough proxy for economic growth. The United Nations expects the world's fertility rate to fall below replacement levels by 2050 (2.1 births per woman), and for population to peak in the mid-2080s (as people live longer), so that model should keep working for at least another few decades.

But when that eventually changes – whether naturally or due to deliberate anti-immigration decisions – our policymakers will need to be acutely aware that recessions will become more frequent, per capita GDP growth will slow (even if workers are still being productive), and various spending and entitlement programmes that we promised ourselves may no longer be affordable.