Friday Fodder (6/24)

Are you being underpaid, how should we best mitigate carbon emissions (and how two prominent government advisors got it so wrong), why we shouldn't bail out the nickel industry, and what's the most important stock on Earth?

Are you being underpaid, how should we best mitigate carbon emissions (and how two prominent government advisors got it so wrong), why we shouldn't bail out the nickel industry, and what's the most important stock on Earth?

All that and more are in this week's short takes for you to chew on over the weekend.

1. Are you being underpaid?

How well are you being paid relative to your co-workers? It's a question everyone has asked at some point in their lives, perhaps with the exception of public sector workers whose pay is set by an award. More broadly, questions that regularly pop up include things like are men being paid more than women? Are white people being paid more than indigenous people? Are older workers less valued than their younger peers?

Those questions have led some governments, such as those in Sweden, Norway and Finland, to mandate full pay transparency across all sectors – information about every individual's income is publicly accessible by law.

But what are the economic consequences of those policy decisions? A new paper in the Journal of Economic Perspectives asked precisely that, starting with a definition of pay transparency (it turns out there are three types):

"To understand the economics behind pay transparency, it is useful to categorise the types of pay transparency into three buckets: horizontal pay transparency, where coworkers at the same organisation are informed of each other's pay; vertical transparency, where transparency extends to different layers of seniority within an organisation; and cross-firm transparency, where workers and/or employers have access to the pay information of competing firms and organisations."

Only two types of pay transparency help people, vertical and cross-firm. Horizontal transparency – where everyone in the firm knows each other's pay – also achieves equality, but at a greater cost:

"Research has shown that employers have responded to horizontal pay transparency by achieving equality through lower average pay overall... Economic theory offers an explanation. Horizontal pay transparency between coworkers within a firm created spillovers between negotiations; specifically, a $1 raise for one worker became more costly due to renegotiations with other workers who have the expectation of equal pay, causing employers to bargain more aggressively with each worker. Moreover, when wages were not equalised under horizontal transparency, research has shown that workers paid visibly less than some of their peers (which can be the majority of workers) felt disgruntled and exerted less effort."

The good news for policymakers is that vertical pay and cross-firm pay transparency come with fewer unintended consequences, and:

"[H]ave proven capable of raising productivity and raising wages by reducing information frictions in the labour market... These pay transparency policies shine the light outward, away from coworkers under the same employer, toward vertical and cross-firm pay differences."

Australia recently banned pay secrecy clauses, which prevented people from discussing their pay with anyone. That seems relatively harmless, and if people use that power to inform websites such as Glassdoor (cross-firm transparency), all the better. But for policymakers looking to improve outcomes for Australian workers, your best bet is to avoid forcing firms to publish individual pay, and instead focus on policies that "educate workers about the full range of opportunities to earn higher wages when they make decisions about what type of work to pursue, how hard to work, and for whom they work".

2. Riddled with failures of basic economic logic

Economists love carbon taxes. Not because they eliminate all carbon emissions, but because they solve a market failure by correctly pricing them, sending a signal about the true cost of different products and services. We then stand back and let people decide how to reduce carbon emissions in the least costly way.

To be equitable, a carbon tax should also be revenue neutral, with the proceeds returned to residents. That could be through an annual dividend, or by reducing other taxes.

Remember, the choice is not between a carbon tax and doing nothing at all. Politicians will do something, and without a carbon tax they tend to favour command and control regulations, taxes and subsidies. Think Clean Energy Finance Corporation, National Reconstruction Fund, Driving the Nation Fund, Critical Minerals Facility, Powering the Regions Fund, Green Initiative Grants. It's a long list – those are just the big ones I could come up with off the top of my head.

At a local level, you end up with stuff like this:

Command and control schemes can work, but they are relatively inflexible, don't account for all the costs and benefits of various options, and suffer from knowledge and public choice problems: politicians have no greater insights than the market, so are just as likely to pick losers as winners, and they may fall victim to rent seeking.

It's for those reasons that command and control solutions are often well down the list of what we might consider optimal in terms of solving a market failure.

Unfortunately, not every economist got the memo. Influential economist Ross Garnaut and former ACCC chair Rod Sims recently joined forces to propose a $100 billion/year tax on fossil fuels with the aim of making Australia a "green energy superpower". According to UNSW Economics Professor Richard Holden, they badly missed the mark:

"The superpower plan involves imposing a $90 per tonne carbon tax on all fossil fuels imported into Australia, and all those produced in Australia, no matter where in the world emissions end up occurring. This would generate about $100 billion a year in revenue, and would be spent on massive subsidies for export-oriented green technology projects (the 'Superpower Innovation Incentive Scheme'), some modest compensation to households, and removing petrol and diesel excise.

...

The plan claims to be market-based but actually involves bureaucratic winner-picking on a scale never seen before. The claim that the subsidies 'only [go] to projects in which Australia has a long-term comparative advantage' in practice involves all manner of subjective judgments, including the rate of learning-by-doing, future global technological developments, and world market conditions decades hence."

I completely agree. Successive federal governments have pissed away billions of dollars on carbon abatement, along with various green subsidies and grants, in an attempt to solve Australia's carbon externality problem. Garnaut and Sims' plan is likely music to the ears of Albo and Chalmers, who have demonstrated a keen interest in continuing to read from the ScoMo/Frydenberg playbook of picking winners as part of their "new approach to industry policy".

But if the Garnaut/Sims plan is adopted, it would do us all a massive disservice.

3. Supply is elastic, nickel edition

When demand for something rises, supply will respond, or we'll find a substitute. It might take a while, especially if it's handicapped by regulations (such as zoning laws for housing), but there will be a response.

That's why government plans such as the "Taskforce on Critical Minerals", announced close to the peak in prices of said minerals, are almost always a waste of a politician's time and energy. Worse, they also waste real resources because when those so-called critical minerals start to fall in price due to the inevitable supply response, cries for government support become very hard for politicians to ignore. Sometimes politicians themselves even do the lobbying. For example, here's WA Premier Roger Cook earlier this week, who has already provided his state's nickel miners with royalty relief:

"What I want to do is to instil a sense of urgency in the Commonwealth to make sure that they've examined all opportunities to support our critical minerals industry. We can see at the moment that the flood of cheaper nickel will have a devastating impact on West Australians. If we want to have a critical minerals industry, we need to actually make sure that we invest in supporting it to make sure it continues to grow."

Cook's comments came after Australia's biggest company, BHP, "announced it would write-off the entire value of its WA nickel portfolio and then some — equating to $5.4 billion — and was considering switching off the mines, putting 3,300 jobs in jeopardy".

While I feel like very few people care about BHP, nobody likes job losses. There are costs when businesses fail, in the form of lost organisational capital and the employees that will have to re-enter the labour market, creating matching problems to be solved (not to mention the impact on the individuals themselves). But companies can't live off government aid forever. How do we know the collapse in nickel prices isn't permanent? In announcing fresh support for the nickel industry, Anthony Albanese claimed that:

"Nickel will be a critical mineral going forward. It's critical for batteries and for other sources as the global economy shifts, as we are seeing, to clean energy."

That may be true, but high-quality nickel is increasingly being produced in Indonesia at prices below what we can achieve here (demand, meet supply). And who knows, perhaps the Chinese-made nickel, cobalt-free LFP batteries are the future, and nickel won't be as "critical" for batteries as Albanese thinks?

Governments also have limited resources. Any support for nickel mines will come at the expense of spending elsewhere, or more debt (future spending). Should we really be shifting spending away from more urgent needs to preserve a few nickel mines?

Australia's nickel reserves are also finite: if we can't mine it economically, why not just leave it in the ground until it's needed? Providing government support so that we can dig up and export it at low prices today instead of at higher prices in the future, when it can be taxed rather than subsidised, seems like a bad deal for Australians (excluding the 3,300 miners and BHP's shareholders, of course).

Attempts to save jobs by resisting economic change almost always backfire, at a cost to the taxpayer well above the wages paid to those workers. Job losses suck, and some individuals will be worse off (government should focus its effort there!), but it's also an important part of economic growth.

4. The most important stock on Earth

The artificial intelligence space is going to evolve rapidly – new industries always do, when they are free to do so. Arguably the biggest beneficiary to date hasn't been the AI companies themselves but Nvidia, which manufactures the graphics cards (GPUs) that their large language models run on.

There's a gold rush and Nvidia is the only one selling shovels, leading Goldman Sachs to label the company "the most important stock on planet earth". Its stock price is up more than 200% over the past 12 months.

But the great thing about competition is that unless your position at the top is protected by government regulation (and even then, you can still be vulnerable – look at taxi plate holders), no one's position is truly secure.

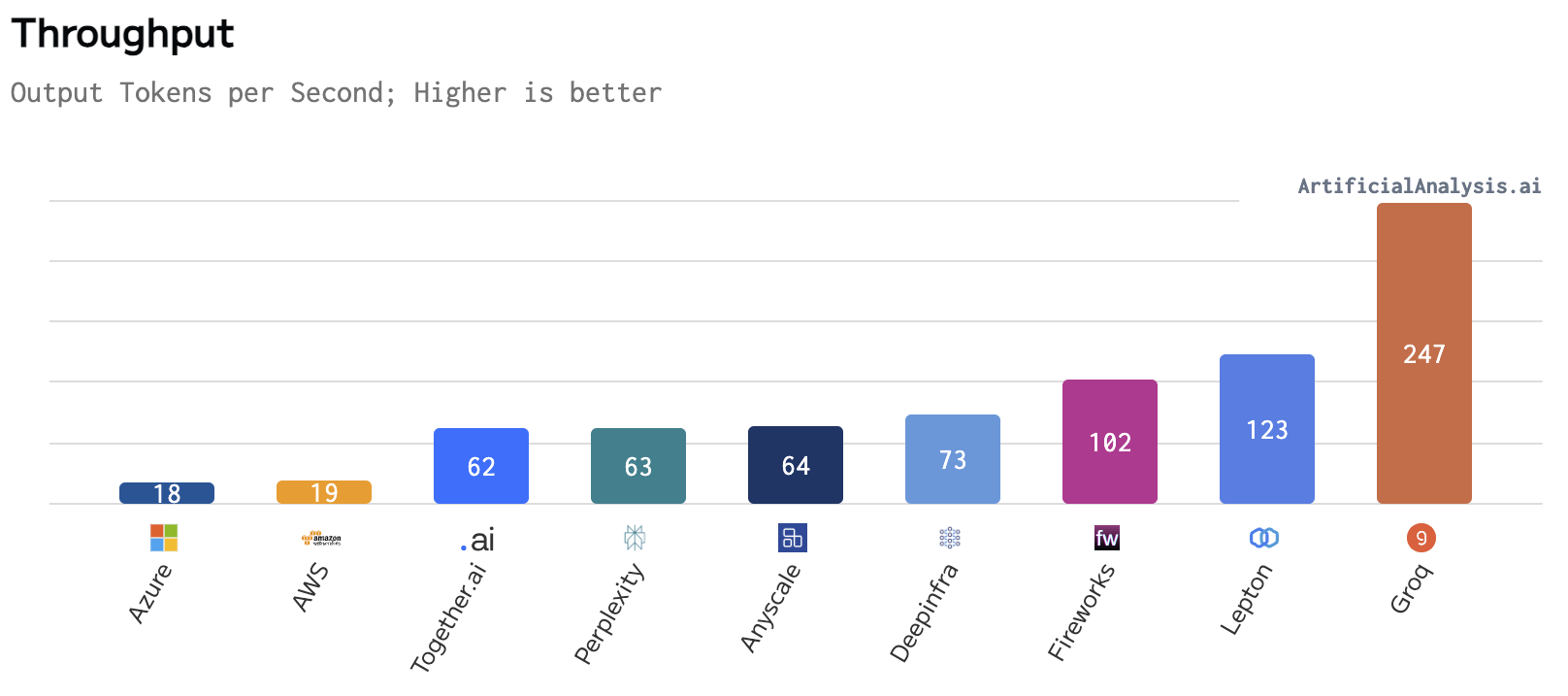

Enter Groq, the world's fastest LLM (not to be confused with Elon Musk's Grok, which is the subject of an amusing cease and desist request):

"Groq started with the compiler, the software that translates code into machine language that can be understood by chips; the goal was to be able to reduce machine-learning algorithms into a format that could be executed on dramatically simpler processors that could operate at very high speed, without expensive memory calls and prediction misses that make modern processors relatively slow.

The end result is that Groq's chips are purely deterministic: instead of the high-bandwidth memory (HBM) used for modern GPUs or Dynamic Random Access Memory (DRAM) used in computers, both of which need to be refreshed regularly to function (which introduces latency and uncertainty about the location of data at a specific moment in time), Groq uses SRAM — Static Random Access Memory. SRAM stores data in what is called a bistable latching circuitry; this, unlike the transistor/capacitor architecture undergirding DRAM (and by extension, HBM), stores data in a stable state, which means that Groq always knows exactly where every piece of data is at any particular moment in time. This allows the Groq compiler to, in an ideal situation, pre-define every memory call, enabling extremely rapid computation with a relatively simple architecture."

That's from Ben Thompson, who draws a link between AI and virtual reality – Groq's speed could mean that "real-time inferencing might be more attainable than we think".

My take is that Nvidia's position at the top is vulnerable. The chips that Groq runs on use almost no HBM, which means it needs a lot of them to run a single model – hundreds. But if you can clear that (expensive) hurdle, Groq offers not only blindingly fast speed but also an alternative to Nvidia's chips, depending on your use case (it's not as good at more complex data processing tasks).

But it's not just Groq that threatens Nvidia. According to Thompson, Taiwan's TSMC is close to releasing its own AI-specific chip, "and Intel is making a credible bid to join them, just as the demand for high performance chips is sky-rocketing thanks to large language models generally". Nvidia might be raking it in by selling the shovels but it may soon face companies offering their own shovels, and perhaps even more powerful diggers.

You can try the lightning fast Groq demo here (thankfully, no account needed!), or read Thompson's full essay here.

5. And if you missed it, from Aussienomics

A Swift loss – Taylor Swift is in town, and so is government spin about the huge economic benefits she brings. But once you account for leakages and opportunity costs, the net impacts are probably negative. Enjoy the show, but don't buy the hype!

How to lose a truck load of cash – My recent Freedom of Information request showed that the RBA Board was warned about the risks of QE but appeared to ignore those concerns, ultimately leading to huge losses with minimal benefits. The fiscal cost alone looks to be well over $50 billion, or more than $5,500 per household – a massive policy blunder.