Friday Fodder (3/24)

Here are a few short takes for you to chew over on the weekend, from the week's happenings that probably didn't need a full post.

1. Boeing's cycle of misery

You may have seen or read about the issues Boeing's commercial aircraft arm has had in recent years. The troubles have led some to ask questions such as why are there only two major suppliers of commercial aircraft, Airbus and Boeing? Why is Boeing still just tweaking the 737 – a 50-year-old design – instead of developing a new aircraft to replace it?

According to Brian Potter, the answer to both questions is that planes are very complex to build, and demand is for small quantities, limiting the business case for new, more innovative models "even if they're physically possible to build":

"Some argue that Boeing could have (and should have) killed the A320 immediately by announcing a new "clean-sheet" aircraft. At the time, Boeing was working on a 737-sized aircraft called the 7J7, which used an advanced "unducted fan" (UDF) aircraft engine from GE. Theoretically, the 7J7 would have been 60% more fuel efficient than existing airliners, along with incorporating technologies like fly by wire. But the UDF engine had unresolved technical issues like high noise generation, and Boeing was concerned with how long it would take to get the 7J7 to market. Instead, Boeing developed another stretched out version of its 737 (the 737-400), cancelled the 7J7 project, and began to develop an aircraft to fill the gap between its 767 and 747, the 777."

Boeing's management never could bring itself to develop a fresh 737, preferring to modify the existing model over and over. With the 737-MAX, it had to go to such extreme lengths – shifting the engines forward and angling them up slightly, then using software to emulate the behaviour of earlier aircraft – that it ultimately contributed to two fatal crashes in late 2018 and 2019 (Boeing decided it wasn't important to inform pilots of the software changes, to save airlines potential retraining costs).

But will those accidents, and the more recent emergency door falling off mid-flight issue, cause Boeing to change their ways, or allow a competitor to break in? Potter thinks that's unlikely, as if anything the airline industry is becoming more like the market for nuclear submarines, where "only a tiny handful of organisations on the planet are capable of constructing [them]".

2. It's all about culture

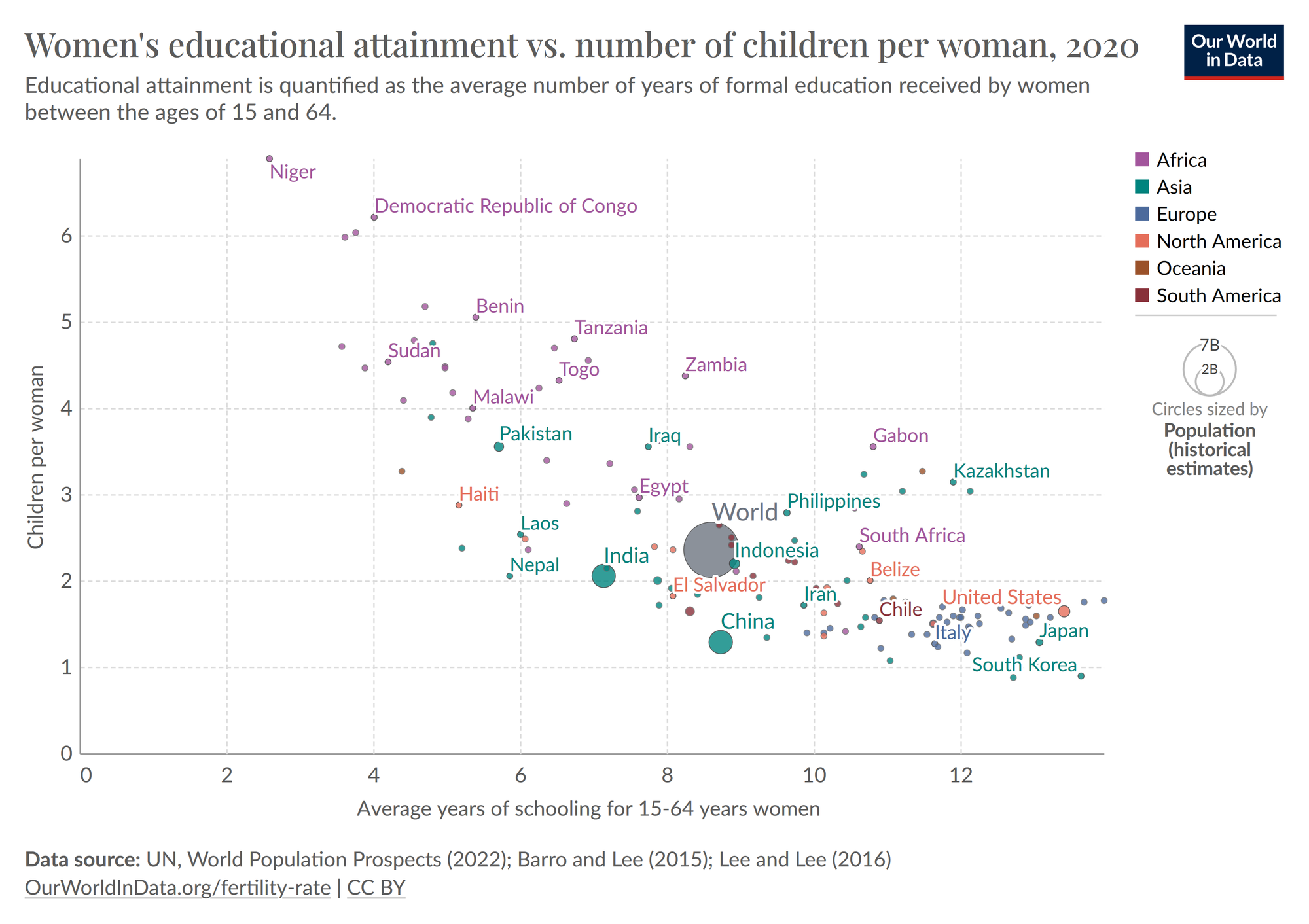

There really isn't much you can do about declining developed-world fertility rates without changing a nation's culture. World class maternity care; generous parental leave; a right to free, pre-school childcare? None of it cuts the mustard:

"Despite all the support offered to parents, Finland's fertility rate has fallen nearly a third since 2010. It is now below the UK's, where the social safety net is more limited, and only slightly above Italy's, where traditional gender roles persevere."

That's from the FT, which recently investigated declining birth rates in one of the world's most gender-equitable societies, Finland. For various reasons – e.g., more economic opportunities, declining religiosity, access to contraception, or even a breakdown in the mating market (Korea) – women are choosing careers over children during their reproductive years.

According to Anna Rotkirch, research director at the Family Federation of Finland's Population Research Institute:

"The strange thing with fertility is nobody really knows what's going on. The policy responses are untried because it's a new situation. It's not primarily driven by economics or family policies. It's something cultural, psychological, biological, cognitive.

In most societies, having children was a cornerstone of adulthood. Now it's something you have if you already have everything else. It becomes the capstone.

...

If you do everything that typical ministers of finance tell you to do, you are 45 — you have a house and a doctorate and it's too late. The idealised life course is really at odds with female reproductive biology."

There's no obvious solution, but Rotkirch recommends governments avoid "knee-jerk reactions" such as restrictions on contraception and abortion, and rather than tell people to have babies for the sake of the economy (Costello's "one for the country" springs to mind), they should tell people that "the economy is there for you to have a baby", i.e., don't worry so much about your future economic security (if only we could trust politicians not to mess that up...).

3. Please, stop trying to pick winners

With Prime Minister Anthony Albanese in tow, Minister for Climate Change and Energy Chris Bowen on Tuesday unveiled:

"$70 million to develop the Townsville Region Hydrogen Hub in north Queensland, creating regional jobs and supporting Australia's future as a renewable energy powerhouse."

There was also another $20.7 million from the taxpayer-funded Australian Renewable Energy Agency, $27 million from the German government, with the remaining $19.3 million coming from "industry". It's not clear who or what is investing the latter sum, but in the press conference Minister Bowen mentioned "James Cook University, Queensland Tafe [state funded], Townsville Enterprise Limited [federally funded]" as partners, and that Edify Energy had won the construction tender.

I don't know the specific details of this hydrogen hub, or whether green hydrogen will even be competitive in the race to provide the world its future energy storage needs (it's certainly not viable today); perhaps it will be a great "investment", as claimed by Minister Bowen, and shower us all with glorious wealth when it comes online in 2027.

However, my spidey sense starts tingling whenever almost all the funding for an "investment" comes directly from governments, government agencies, and government-funded enterprises – entities that have very little skin in the game. For all we know, this Townsville hydrogen investment could be the modern-day equivalent of committing Australians to Dvorak keyboards, or Betamax cassettes. They may have been better technologies than QWERTY and VHS, but that's not necessarily what determines what consumers want.

4. China's slowing down, again

You may have seen that, at long last, the Chinese government ordered the liquidation of China Evergrande Group. Evergrande was the poster child of China's property bubble, a developer that levered to the hilt because when prices always rise, that's a great way to make money. Until they don't.

Bloomberg provided a handy list of measures Beijing has taken just this year to "boost" the Chinese economy:

- 5 Jan: encourage banks to provide loans for developers, industrial zones, certain rural organizations and companies to build new homes for long-term renting or renovating existing facilities for that purpose.

- 15 Jan: 1 trillion yuan of new debt issuance under a so-called special sovereign bond plan... to fund projects related to food, energy, supply chains and urbanisation.

- 19 Jan: evidence of state buying to offset selling momentum amid an epic bubble bursting.

- 23 Jan: 2 trillion yuan share buying package to stabilise the stock market and investor confidence.

- 24 Jan: cut the reserve requirement ratio — the amount of cash lenders must keep in reserve — by 0.5 percentage points on 5 Feb to release 1 trillion yuan in long-term liquidity to the market.

- 26 Jan: create a list of housing projects eligible for funding support, the latest attempt to boost lending for real estate to slow the sector's slump.

- 27 Jan: Guangzhou, one of China's biggest cities, further loosened home-buying curbs in a bid to stem falling prices. Beijing, Shanghai and Shenzhen have lowered down-payment requirements since November.

- 28 Jan: halt the lending of certain shares for short selling, the latest attempt to put a floor under the stock market rout.

- 1 Feb: issued 150 billion yuan in loans to state-owned policy banks, in a bid to support its troubled property sector.

Beijing wants to maintain stability (power) more than anything else. These measures, to various extents, socialise the losses from past mistakes to avoid contagion, with credit "continually channelled to unproductive uses", at the cost of long-term growth.

5. And if you missed it, from Aussienomics

The unintended consequences of the vaping crackdown: The government's recent vaping crackdown will impose huge costs on users, drive some to the black market and force others to smoke more cigarettes, despite vapes being far less harmful than smoking. Instead of prohibition, regulate vapes like alcohol: legalise, enforce age limits, tax moderately, and educate about harms.

Inching towards affordable housing: The year has started well, with NSW, WA and SA all announcing steps that will increase housing supply, even if some of the others are going backwards. But to improve housing affordability for good, we need to ensure it's politically sustainable. That means communicating with locals and lifting density across entire cities, not just in 'well-located' areas. We should probably ditch the housing completion targets, too – they do more harm than good.