Friday Fodder (10/24)

Tasmanians will go to the polls tomorrow but it's looking like it'll be more of the same; I ask whether you should you fly on a Boeing; why Xi Jinping's leadership meant Evergrande was inevitable; and what's going on across the ditch.

1. More of the same for Tassie

It's election day for our smallest and only Liberal-run state tomorrow, and things are looking reasonably good for the incumbent Premier, Jeremy Rockliff. In fact, bookmakers are so confident that the Liberals will form government that they're paying a miserly $1.08, which is about the worst you'll get on anything this weekend other than a bet on the West Coast Eagles getting thumped by the GWS Giants, which is paying $1.06.

But notice I said that the outcome was only reasonably good for the Liberals. According to a recent uComms poll for the Australia Institute, while 37.1% of the primary vote was expected to back in another term for the government that won't be close to enough for a majority, with most voters (58.4%) expecting a "hung parliament where the government must work with other parties and independents to pass legislation".

That's a problem for Rockliff, who called this election more than a year earlier than he had to precisely because of his lack of a majority. As he said at the time:

"The only way to restore the stability and certainty Tasmanians need is to re-elect a majority Liberal government."

We'll see if Rockliff resigns, or calls another election, when that doesn't happen; somehow, I doubt it! That's because – other than his personal political ambition, of course – Rockliff may not have to "deal" with ex-Liberal Party members John Tucker and Lara Alexander this time around, who quit over Tasmania's dodgy AFL stadium deal and are the real reason this election was called: Rockliff wants those seats back.

So how might this new minority government look? If we look back at the uComms poll, only 60.1% of people expect to vote for the Liberals or Labor, meaning the new Parliament could well be more politically diverse than the one Rockliff ripped up. The only consolation for the Liberals will be if the Jacqui Lambie Network (8.5% voter intention) and independents (12.8% voter intention) are more willing to compromise on key issues than they were last time around, giving Rockliff the supply and confidence he needs to maintain power for another term.

2. Should you fly on a Boeing?

Boeing has been in the news for all the wrong reasons lately, starting with the tragic crashes of the 737 MAX 8 aircraft in 2018 and 2019, but most recently because of an incorrectly installed door plug that caused an explosive decompression.

Those incidents raise the question: how unsafe are Boeing aircraft today, and should you avoid them if you can?

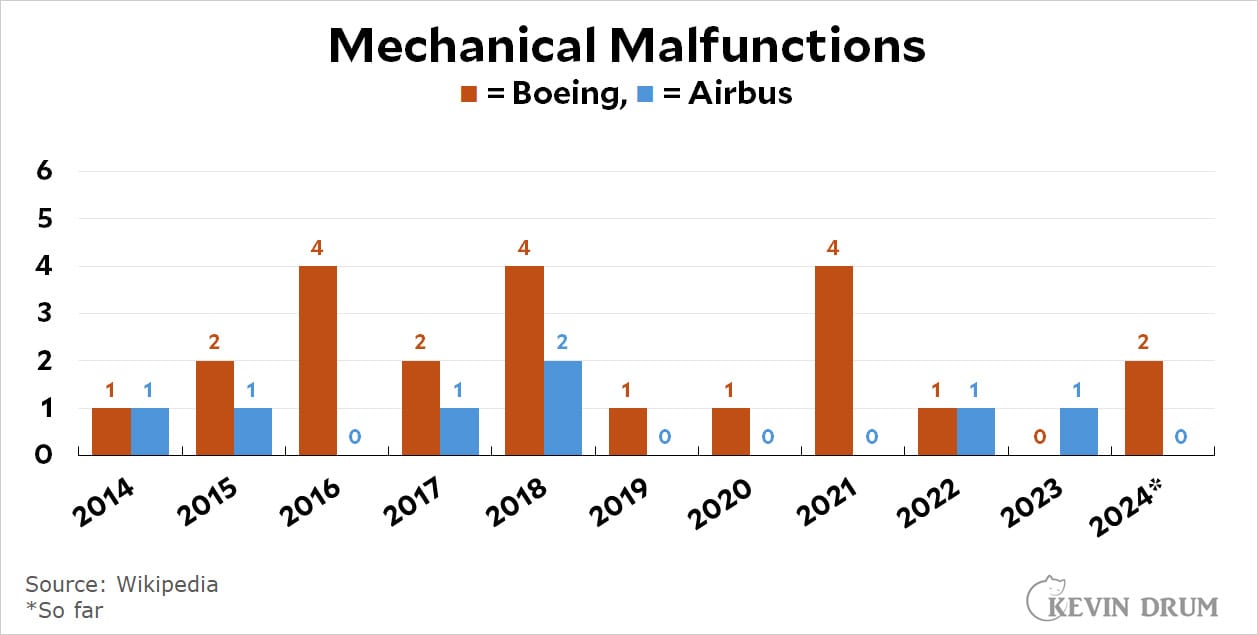

To find out, we should of course look at the data, and fortunately there are at least two sets that track incidents globally and in the US by type of aircraft. The first is everyone's favourite source, Wikipedia, which does a good job of listing all major commercial airline incidents. Kevin Drum converted it to chart form:

Clearly, to be rigorous one would need to adjust these data for the denominator. For example, just how many Boeings are flying compared to Airbuses, how many hours, how old is the fleet, and so on. But if we assume they're broadly comparable – Airbus says it has 13,724 in operation, versus Boeing's "more than 10,000" – then Boeing is definitely less safe, but not by much.

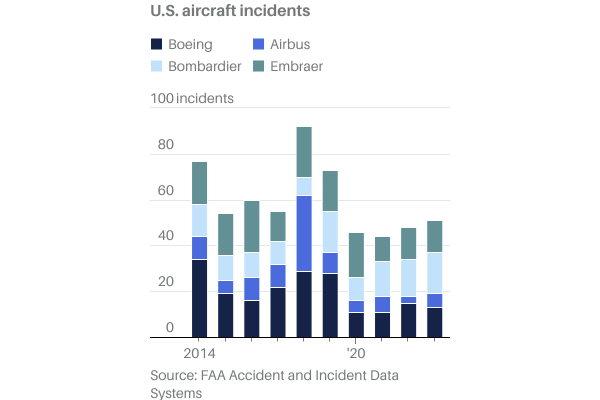

The second data source is from the US FAA. In the US, there are around half as many Airbuses flying as Boeings, so you'll need to adjust for that, but it shows that "there has NOT been an uptick in Boeing incidents, just in press coverage of Boeing incidents".

Boeing's slow demise as a company has been well documented. But so far, at least, passenger safety hasn't been compromised as much as the media makes it seem, and air travel is still safer than any other form of transportation, especially your trip to and from the airport.

3. Xi Jinping style

Since coming to power in 2013, Xi Jinping's response to every economic obstacle has been to avoid ripping off the proverbial Band-Aid; to consolidate power and avoid crisis at all costs, even if it means a poorer China in the long run.

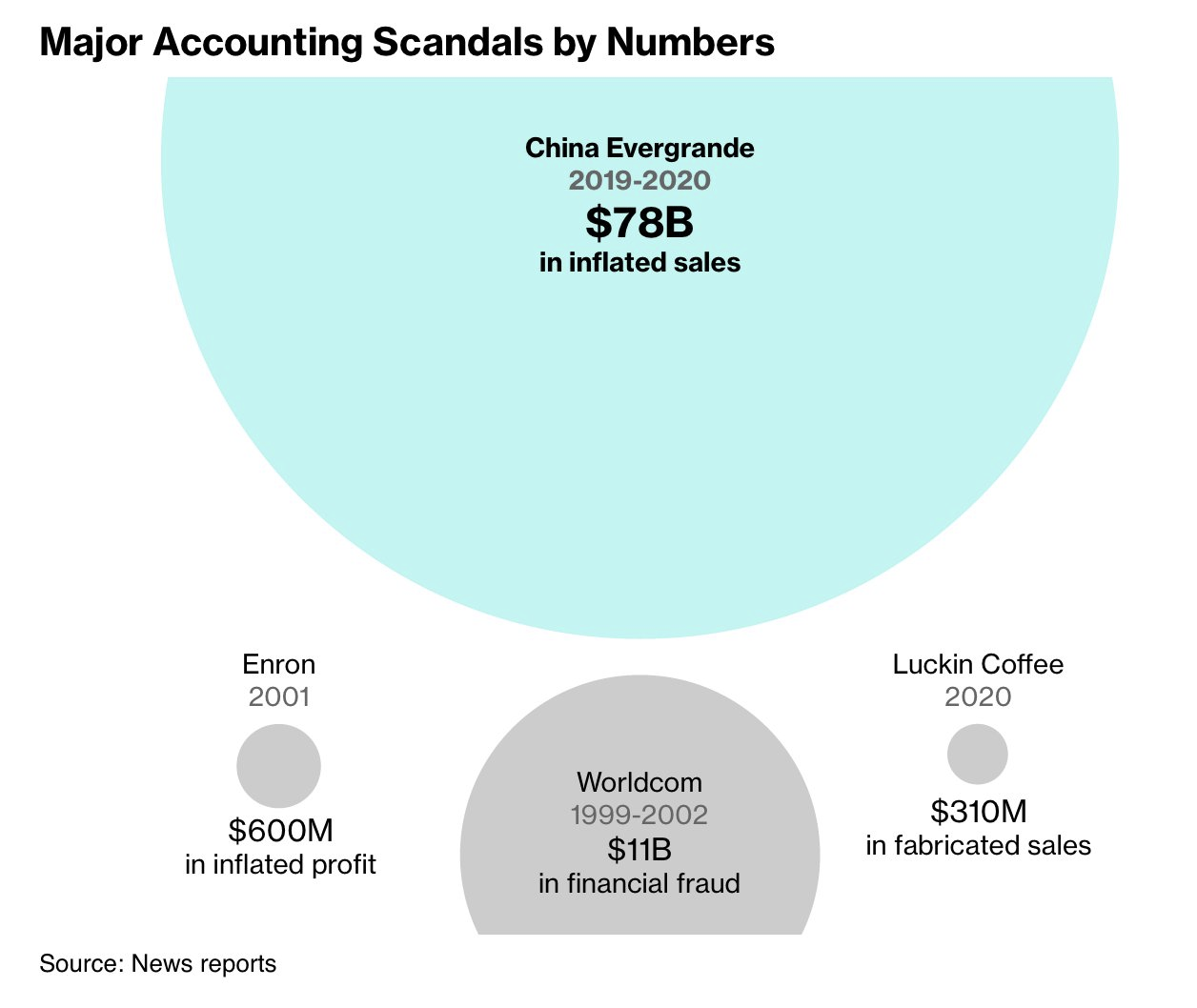

But when you're in the business of kicking the can down the road, eventually some problems get so large that they can no longer be ignored. Enter Evergrande, the once high-flying real estate developer that, we now know, was falsely inflating "revenue by more than $78 billion in the two years leading up to its failure".

Yikes. For context, that makes China's Evergrande the biggest accounting scandal in history:

China will, of course, be 'fine'. According to Cornell University's Eswar Prasad:

"Most major Chinese banks are under state control and can provide infusions of cash to troubled corporations, even if that only pushes problems off into the future."

But one can only wonder whether Evergrande was the only company engaging in creative accounting, and how all the poor investments made by such companies, not to mention government-run enterprises and the government itself, will sap productivity in the coming years. Add that to China's growing geopolitical risk and it's not a good sign for investors, given an interesting new paper found "that geopolitical risk substantially affects firms' default probability and market valuations". Buyer beware.

4. What's going on across the ditch

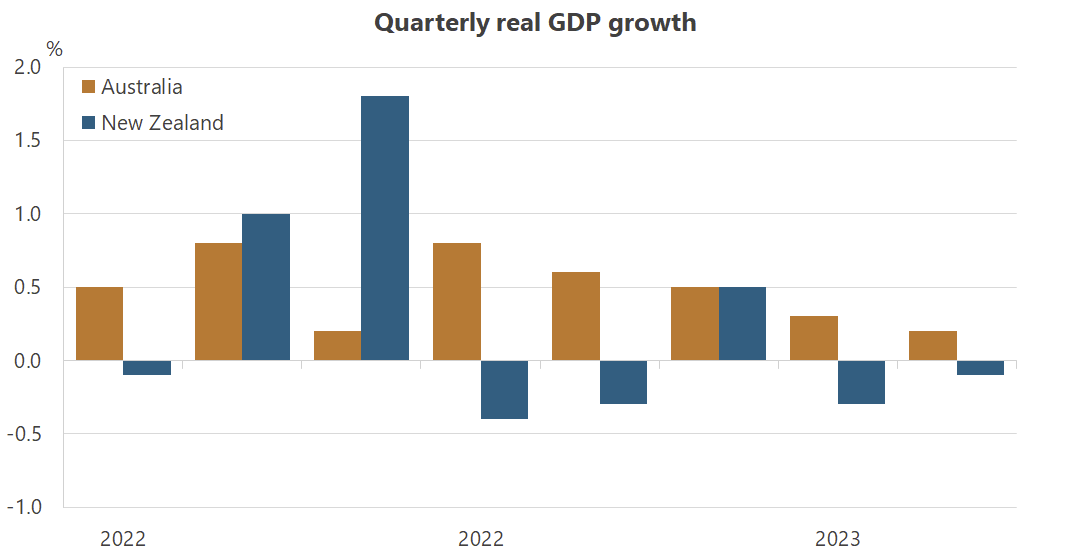

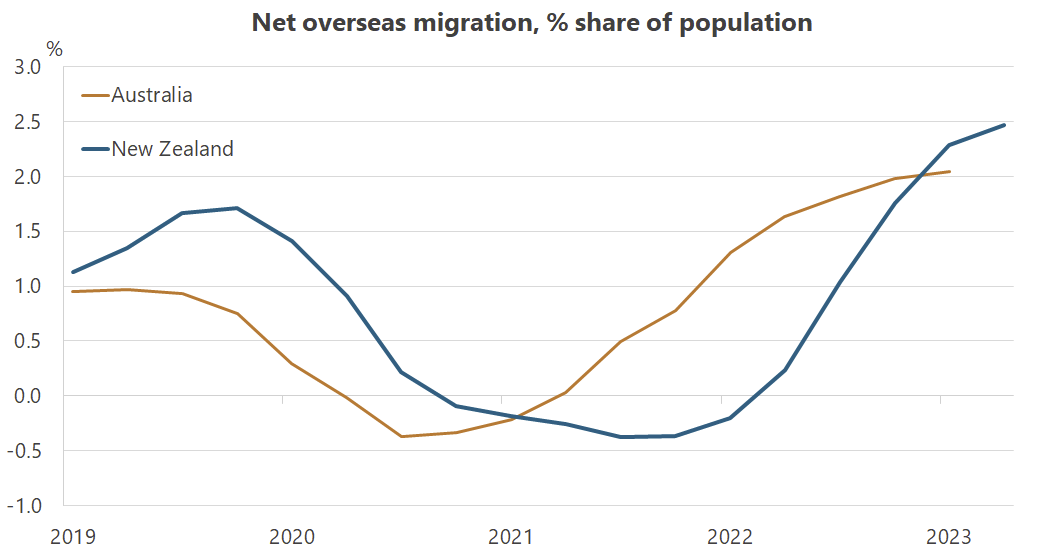

New Zealand is one of the few advanced economies currently in recession, in both absolute and per capita terms, having officially 'double dipped' in the December quarter of 2023.

The economic decline came even with rates of migration comparable to ours, which would have added to overall growth.

So it was timely that the IMF concluded its annual "mission" in New Zealand earlier this week, recommending that the Kiwis undertake:

"Structural reforms... to boost the housing supply, revive productivity growth, lower emissions, and address challenges from climate change."

Australia could do well with a lot of that, too, given how slowly we're growing despite 3.7% unemployment and significant state and federal deficit spending flattering the aggregates.

But back to New Zealand, where the IMF correctly advised it to get its fiscal house in order:

"In IMF staff's view, restoring an operating surplus in the 4-year forecast period should remain the objective, underpinned by efficacious caps on operating allowances. This could strengthen credibility and preserve the policy space to respond to shocks. Spending reforms should be based on a comprehensive cost-benefit analysis of government programs and address long-term aging-related fiscal pressures. The focus should be on spending areas which have increased the most since the pandemic, such as the wage bill, transfers, and social benefits. Outlays on high-value infrastructure and support to the most vulnerable should be protected."

It's a big worry of mine that when the next shock comes – and it will – Australia will also find it difficult to mount a credible fiscal response, given all levels of government have been spending like we're in a crisis for the last four years. There was absolutely no good reason for doing so once we had reopened from the pandemic, and to borrow from Black Swan author Nassim Taleb, it has made us economically fragile.

But that's enough rambling for today; I'll have more on that subject next week. For now, have a great weekend!

5. If you missed it, from Aussienomics

Powering our AI future – If Australia's policymakers don't address the rising energy demands of AI, we risk falling behind other advanced nations. Despite its many critics, nuclear is a potential solution alongside renewables, and should not be ruled out so cavalierly.

Rethinking the National Broadband Network – My NBN connection shat itself earlier this week so I fired up my 5G hotspot and investigated how and why we ended up with the government-owned corporate broadband monopoly we have today and what we can do to improve it.